Kingston residents are facing an almost 5 per cent hike in their council tax this year as mounting pressures squeeze the council’s budget. Kingston Council needs to find an extra £15.7 million in the 2024/25 financial year to meet rising costs and increasing demand for services.

The authority has set out plans to balance the books for 2024/25, including a proposed 4.99pc rise in its share of council tax. This is the maximum increase allowed without holding a referendum.

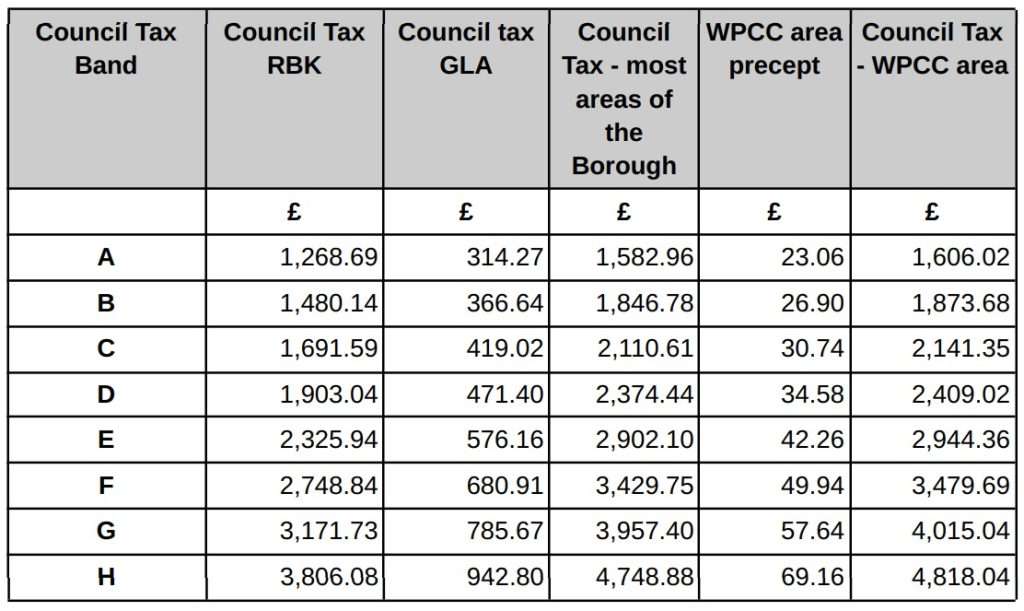

The proposed hike means the average band D household in most areas of Kingston would pay total council tax of £2,374.44 in 2024/25. This includes an increase in the council’s share of the bill by £90.47 to £1,903.94. Mayor of London Sadiq Khan’s share is set to increase by £37.26 for the average band D household to help fund police, fire and transport.

A council report on the budget proposals said: “Along with many councils we are proposing increasing council tax to help meet the financial pressures of increasing demand and rising costs. We understand that any increase will have an impact on residents. However there is a need to balance this with the need to protect services and continue to provide support, advice and care for the most vulnerable people across the borough.”

The authority is planning to set its 2024/25 budget at £178m over the coming financial year, while it needs to save an extra £8m. Global conflicts, inflation, the Covid-19 pandemic and pressure on local government finances are among the challenges it faces, it said, along with demand on its services increasing in volume and complexity – particularly for adult and children’s social care and temporary accommodation, on which it has spent more than £100m in 2023/24.

The council said it plans to deliver the budget largely through transforming how it delivers services. Proposals it has outlined to achieve this up to 2027/28 include adopting stricter enforcement of parking fines, new parking permit areas, scrapping the majority of support for home to school transport for people over the age of 16 and cutting vacant jobs.

The authority has provided a breakdown of the total council tax residents in most areas of Kingston will pay if the proposed 4.99pc increase is applied, including the Mayor’s share of the bill. This is summarised below:

- Band A: £1,582.96

- Band B: £1,846.78

- Band C: £2,110.61

- Band D: £2,374.44

- Band E: £2,902.10

- Band F: £3,429.75

- Band G: £3,957.40

- Band H: £4,748.88

The authority has also predicted the total council tax residents subject to the Wimbledon and Putney Commons Conservators’ (WPCC) levy would pay under the proposals, which has been estimated at £34.58 for the average band D household in Kingston. The exact sums will be confirmed when the levy is formally announced on February 15.

- Band A: £1,606.02

- Band B: £1,873.68

- Band C: £2,141.35

- Band D: £2,409.02

- Band E: £2,944.36

- Band F: £3,479.69

- Band G: £4,015.04

- Band H: £4,818.04

The government lifted the referendum cap in November 2022, which means councils can raise taxes by 4.99pc annually without the need for it to be voted in by residents. The increase includes 2.99pc for general use and an extra 2pc for adult social care.

Residents on a low income or claiming certain benefits can get help on their bills through the council tax reduction scheme. Kingston Council will make a final decision on the budget proposals on February 29.

Image one: Table showing council tax proposals for 2024/25 in Kingston. Credit: Kingston Council

Image two: Guildhall, Kingston. Credit: Google Maps